User Onboarding - CX Journey Mapping

When people want access to vital credit, they conduct enormous manual research to find attractive interest rates and more importantly zero-in on the right institution willing to extend them the credit.

MoneyTap, a credit-extending app for the general public, sought to implement a groundbreaking avenue for people to get access to credit by building an innovative financial infrastructure incorporating the summary of the user’s credit history (CIBIL score) and a biometric ID (Aadhaar Card).

The goal as the UX Consultant was to design a conducive user experience which encompasses the vastness of the financial system into an app that allows Indian users to get quick access to credit.

Task

To improve the UX of the existing application by removing redundancy in navigation and enable effective form filling which was an integral part of the application.

Client Discovery

Interviewed stakeholders and established the scope & time.

Worked with the product team to isolate the pain points in the flow.

Mapped the user flow of the current app.

Information Architecture

Observations

Broken user flow - data sets intermittent.

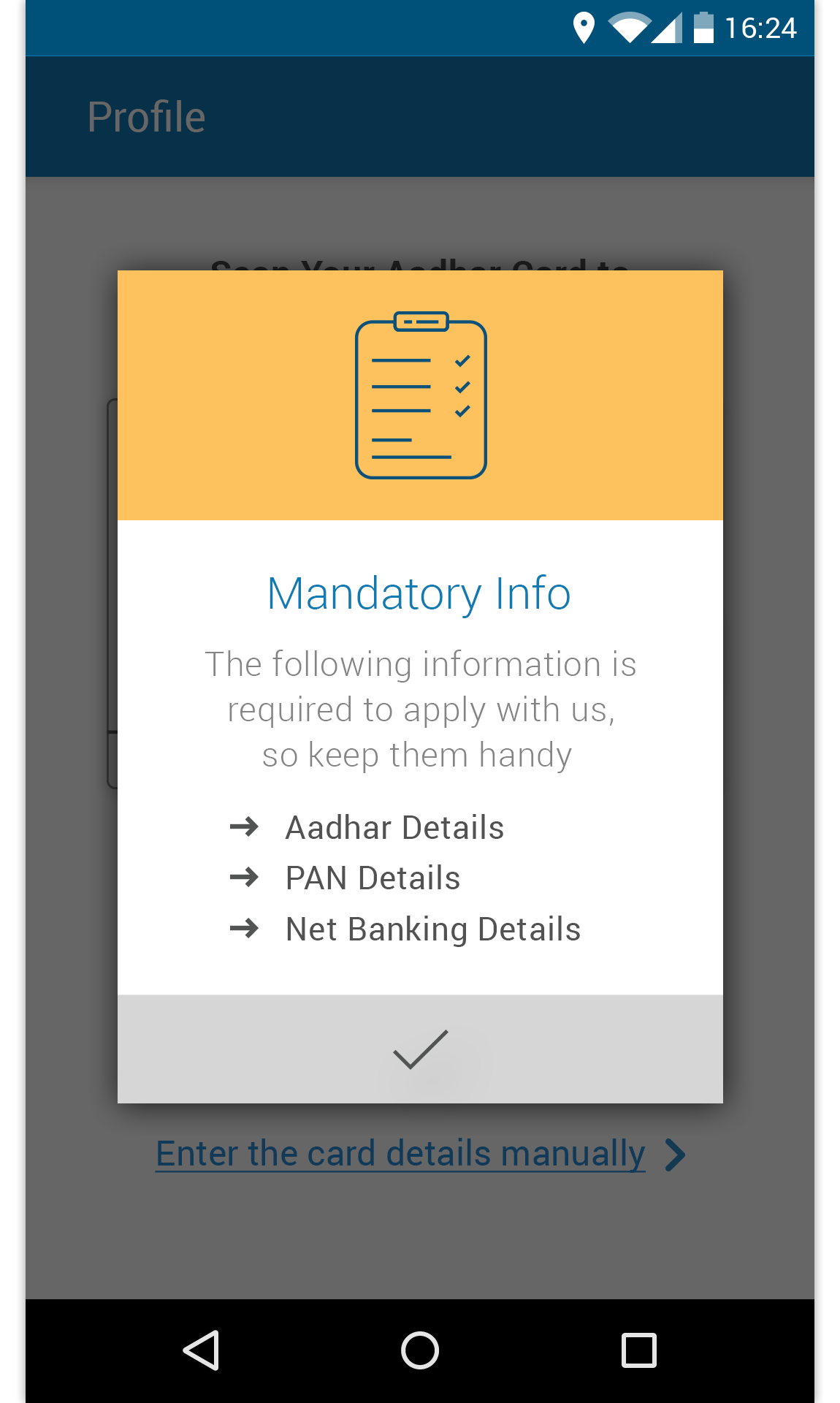

Exhaustive form filling - user exposed incessantly to 15 sections of data entry.

High interaction cost - user goes through 45 screens to reach the objective.

Opportunity

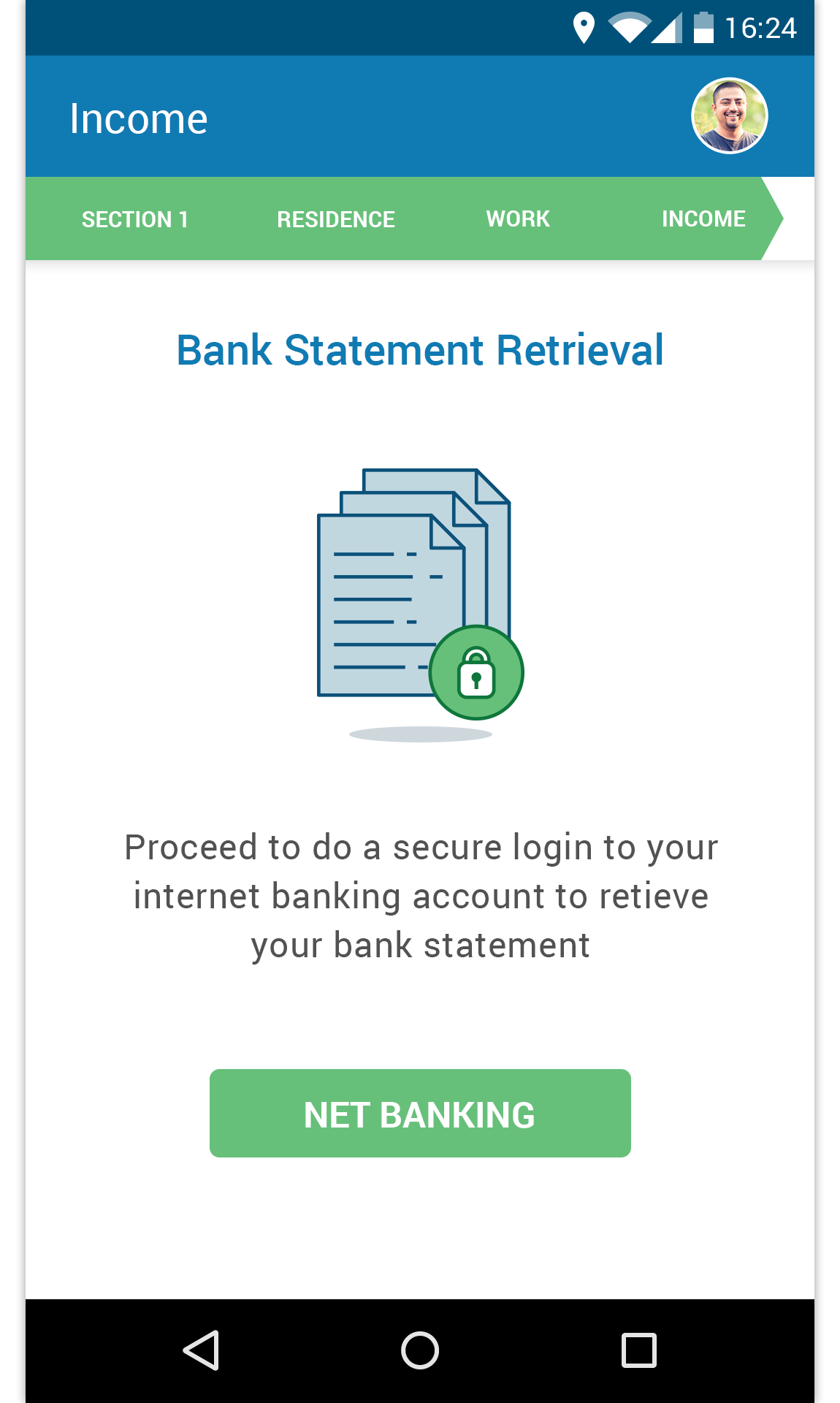

Tweak the information architecture - rearrange data sets to be more pertinent to the section label.

Provide a 'break' in the flow - to display state of completion and inform the user on the impending flow to provide encouragement to complete the form.

Reduce the interaction cost by reducing the number of interactions - saving valuable time and cognitive workload.

Design Process

As the UX consultant, I carried out the design process in collaboration with the in-house product team.

1. Sketching

The process established the dimension of the project with limited collaboration and provided for easy iteration. Consequently, it helped transform abstract ideas into a concrete solution.

2. Wireframing

The process solidified the initial idea. Provided for more collaboration among the team and informing the broader group - product, engineering, and stakeholders about the user flow.

3. UI Design & Visual Design

In the UI design phase, I worked with the engineering teams on exploring reusable UI components. It also entails fixing the visual design elements like colors, iconography, typeface, etc.